Carbon Credit Trading Scheme Targets

Syllabus Areas

GS III - Economy, Environment

The Indian government recently announced greenhouse gas emissions intensity of production targets for entities (such as a steel plant) operating within eight of the nine heavy industrial sectors covered in India's Carbon Credit Trading Scheme's (CCTS) compliance mechanism.

“Are these targets ambitious enough to help India reach its 2030 and 2070 climate goals?”

2030 Climate Goals (India’s NDC – Nationally Determined Contributions)

India submitted its updated NDCs (National Climate Goals) in August 2022 and reaffirmed these targets:

- Reduce Emissions Intensity: India aims to reduce the emissions intensity of its GDP by 45% by 2030 compared to 2005 levels.

- Renewable Energy Capacity: Increase the share of non-fossil fuel-based energy capacity to 50% of total installed capacity by 2030.

- Carbon Sink Enhancement: Create an additional carbon sink of 2.5–3 billion tonnes of CO₂ equivalent through afforestation and tree cover.

- Sustainable Lifestyles: Promote the concept of LiFE (Lifestyle for Environment) to encourage responsible consumption.

- Adaptation Measures: Strengthen resilience to climate impacts across sectors like agriculture, water resources, and health.

2070 Climate Goal – Net Zero

India has committed to achieving Net Zero emissions by 2070, announced by PM Modi at COP26 in Glasgow (2021).

What is Net Zero?

Achieving a balance between the GHGs emitted and those removed from the atmosphere through:

- Renewable energy use

- Carbon capture technologies

- Forest-based carbon sinks

Background:

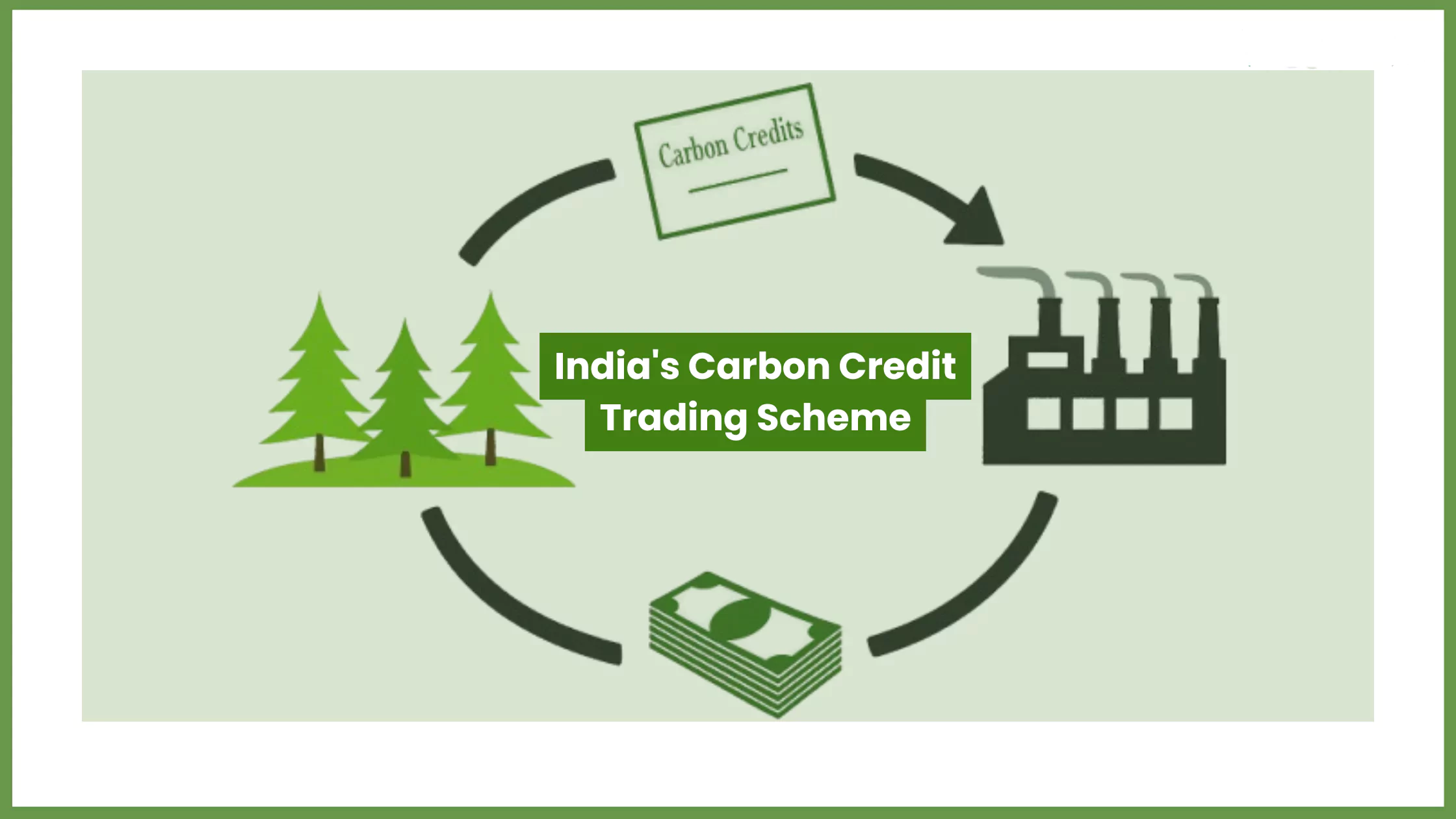

INDIA'S CARBON CREDIT TRADING SCHEME (CCTS)

- Launched: 2023–24

- By: Ministry of Power and Bureau of Energy Efficiency (BEE)

- Status: Being implemented in phases

How does it work?

| Step | What Happens? |

|---|---|

| 1. | The government sets emissions intensity targets (for 8 industries). |

| 2. | Companies report their emissions per unit output. |

| 3. | If emissions are less than target → they earn carbon credits. |

| 4. | If emissions are more than target → they must buy carbon credits. |

| 5. | Credits are traded on a regulated market platform. |

What is Emissions Intensity?

- It is the amount of CO₂ emitted per unit of output.

- g., 1 ton of CO₂ per ₹1 lakh of production value.

- Lower emissions intensity = cleaner and more efficient production.

What is a Carbon Credit?

- A permit to emit 1 ton of CO₂ or equivalent.

- If a company emits less than its quota, it gets extra credits (which it can sell).

- If it emits more than allowed, it must buy credits.

Carbon Markets / Emissions Trading Schemes (ETS)

- These are market-based tools to cap and reduce

- Each factory gets a limit (say 1000 tons CO₂). If it emits less (800 tons), it can sell the extra 200 tons as carbon credits to others.

- If another factory emits more (say 1200 tons), it must buy credits to stay legal.

- The idea: let market forces help reduce emissions at the lowest cost.

Main Discussion Points:

Entity vs Sector vs Economy-Level Analysis:

To understand whether the targets are ambitious, the correct lens is economy-wide, not sectoral or entity-specific. The ultimate goal of such a trading scheme is aggregate emissions reduction, not uniform performance across all units.

Learnings from PAT Scheme:

India's previous Perform, Achieve and Trade (PAT) energy efficiency scheme showed:

- Some sectors/entities improved, others did not.

- Overall energy intensity decreased across the economy.

- Market mechanism (like certificate trading) ensured aggregate targets were met even if some players fell short.

Flawed Benchmarking with Past Trends:

Comparing CCTS targets with historical sector-level PAT performance is not appropriate.

- Past performance was modest.

- Future targets must be more ambitious to align with India's NDC goals and 2070 net-zero

What Should Be the Benchmark?

- A trajectory aligned with India’s NDC (Nationally Determined Contributions) and long-term net-zero goals.

- Modelling analysis suggests India needs a 44% annual decline in emissions intensity of energy sector GDP from 2025 to 2030.

- Manufacturing EIVA (Emissions Intensity of Value Added) needs to decline by at least 2.53% annually.

Current CCTS Projections Fall Short:

- Based on early estimates using commodity prices + production growth, current targets project only 68% annual EIVA reduction (2023–27). This suggests underambition compared to required decarbonisation rates.

Sectoral Targets Have Limited Value:

- Sector/entity-level targets only affect financial flows between firms (through trading), not actual aggregate emissions. Thus, focusing too much on these misses the big picture.

Prelims Questions:

- Which of the following best explains the core principle of an Emissions

Trading Scheme (ETS) like

India's CCTS?

- Uniform emission cuts across all sectors

- Equal financial penalties for exceeding emissions

- Aggregate emissions reduction through market mechanisms

- Sector-wise carbon neutrality

Ans: C

- In the context of India's Perform, Achieve and Trade (PAT) scheme, which of

the following is

correct?

- Every entity must reduce its energy intensity individually

- Market trading of energy efficiency certificates is not allowed

- Sector-level increases in energy intensity are penalized

- Entities can trade energy savings to meet aggregate efficiency goals

Ans: D

- What does the term "EIVA" refer to in the context of emissions

policy?

- . Emissions Intensity of Value Added

- Energy Incentives for Vertical Allocation

- Emission Index for Verified Assessment

- Economic Index of Value Adjustment

Ans: A

Mains Question:

- "What do you understand about emissions intensity and carbon trading? How do market-based mechanisms like the Carbon Credit Trading Scheme (CCTS) help in achieving climate goals while ensuring economic efficiency?" 250 Words 15 Marks