Bombay Stock Exchange

Syllabus Areas:

GS III - Economic Development & Growth

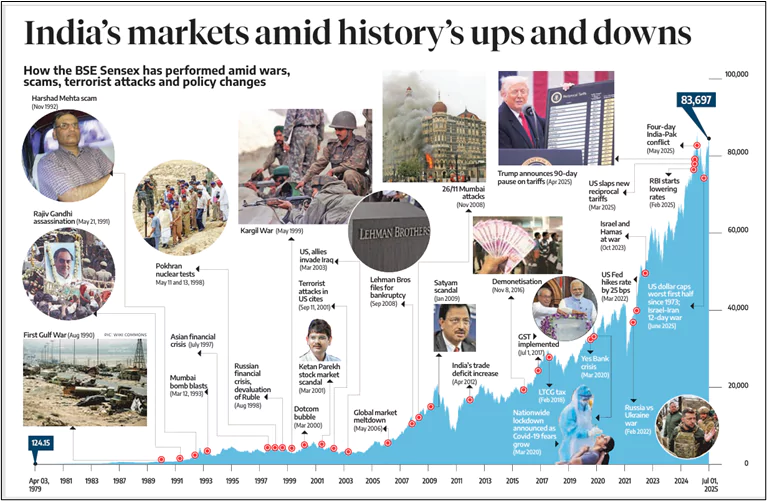

On July 9, 2025, the Bombay Stock Exchange (BSE) marked its 150th anniversary since the founding of the Native Share and Stock Brokers’ Association in 1875. As Asia’s oldest stock exchange and a cornerstone of India’s financial architecture, this milestone provides an opportunity to review the evolution, significance, challenges, and reforms of the BSE — critical for understanding India’s economic and regulatory history.

- Bombay Stock Exchange (BSE) is the first and oldest stock exchange in Asia.

- Headquartered at Dalal Street, Mumbai, it plays a key role in India’s capital markets.

- It is now a listed company, valued over ₹1 trillion as of 2025.

Evolution of BSE:

- 1850s – Informal trading began under a banyan tree in Bombay with 20–22 brokers.

- 1875 – Formation of the Native Share and Stock Brokers’ Association, marking Asia’s first formal stock exchange.

- 1899 – First dedicated BSE building inaugurated on Dalal Street, Mumbai.

- 1957 – BSE received permanent recognition under the Securities Contracts (Regulation) Act, 1956, giving it legal legitimacy.

- 1986 – Launch of Sensex (short for Sensitive Index) , India’s first equity index, representing 30 top companies and tracking market performance.

- 1995 – Introduction of BOLT (BSE Online Trading), shifting from open outcry to screen-based electronic trading.

- 2012 – Launch of SME Exchange Platform to enable small and medium enterprises to raise capital.

- 2017 – BSE became a listed entity, enhancing transparency and corporate governance.

What is a Listed Entity?

A listed entity (or listed company) is a company whose shares are officially listed and traded on a recognized stock exchange, such as the Bombay Stock Exchange (BSE) or National Stock Exchange (NSE) in India.

- 2025 – BSE’s market capitalization crossed ₹1 trillion, making it the fifth-largest stock exchange

Major Crises and Reforms in BSE History

Speculative Mania & The 1865 Crash

- Led by Premchand Roychand, speculation surged due to the cotton boom during the American Civil War.

- Forward contracts and aggressive leverage led to a crash when the war ended.

1993 Mumbai Blasts

- A bomb exploded at BSE building killing 257 people.

- Marked a decade of turmoil including scams and erosion of public trust.

Harshad Mehta Scam (1992)

- Market manipulation using banking loopholes.

- Led to establishment of SEBI and eventually creation of NSE.

Recent Trends and Economic Significance

- India’s equity market grew nearly 700x since 1979 with a CAGR of 15%.

- Outperformed global peers like US (S&P 500 ~50x), Japan, and Germany.

- Indian stock market showed resilience through crises:

- 1973 Oil Crisis

- 1990 Gulf War

- 2008 Global Financial Crisis

- 2020 COVID-19 Lockdown

- 2025 Israel-Iran tensions

- Market Cap (2025): ~$5.4 trillion (5th largest globally).

- Demographic Edge: Median age ~27.6, youth bulge fuels savings and investment.

- Reform Momentum:

- Flexible inflation targeting (RBI)

- SEBI’s investor-friendly regulations

- Allowing pension funds in equity (akin to US 401(K))

Prelims Questions:

- With reference to the Bombay Stock Exchange (BSE), consider the following

statements:

- The Sensex was introduced in 1986 and is based on 100 companies representing all sectors of the Indian economy.

- BSE transitioned to electronic screen-based trading through the BOLT system in 1995.

- BSE was the first stock exchange in India to launch a dedicated platform for Small and Medium Enterprises (SMEs).

- BSE was recognized under the Securities Contracts (Regulation) Act, 1956 in the same year it was founded.

- 1 and 2 only

- 2 and 3 only

- 1, 2 and 4 only

- 1, 3 and 4 only

- Statement 1 is incorrect: Sensex represents 30, not 100, top companies.

- Statement 4 is incorrect: BSE was founded in 1875, but recognized under the Act in 1957.

- Government takeover of private trading enterprises.

- Practice of stock exchanges limiting foreign investment.

- Manipulative tactic where bulls hoard shares to trap short sellers.

- Regulation introduced to control speculative contracts.

- "Cornering" was a form of market manipulation where bulls created artificial scarcity to trap bears.

- Bears are traders who expect a share price to fall. So, they sell shares they don’t own today (called short selling) hoping to buy them later at a lower price and make a profit.

- Bulls are traders who expect a price rise.

- They buy and hold shares, often in large quantities.

Which of the statements given above are correct?

Answer: (b) 2 and 3 only

The term "cornering" in the context of early 20th-century Indian stock markets refers to:

Answer: (c) Manipulative tactic where bulls hoard shares to trap short sellers.

Mains Question:

Q. Discuss the evolution of Bombay Stock Exchange and its impact on Indian financial markets.” 150 Words 10 Marks